TJ Chambers

Onsales, In-Demand Pricing, the Capping of Ticket Resale, and Monopoly

Bloomberg’s coverage of the business of entertainment, Hollywood, television, sports, streaming, and the various industry moguls, celebrities and entrepreneurs, extends from the digital and printed media to also encompass events.

This post is prompted by the recent ‘Bloomberg Screentime’ conference in Los Angeles which attracted an impressive array of speakers to the event including Bela Bajaria, Chief Content Officer Netflix; Keily Blair, CEO OnlyFans; Mike Hopkins, Head of Prime Video and Amazon MGM Studios; and Rob Stringer, Chairman Sony Music Group, amongst others.

But of particular interest was the session hosted by Lucas Shaw (Managing Editor Media and Entertainment, Screentime) with Michael Rapino President and CEO Live Nation Entertainment (LNE): https://www.bloomberg.com/news/videos/2024-10-10/live-nation-s-rapino-on-events-growth-and-competition-video.

For analysts, media and observers the thirty minutes of Q&A included an interesting number of comments and revealed some insight as to the current thinking from the self-described ‘world’s leading live entertainment company’.

***

© Bloomberg Screentime 2024 – Michael Rapino

The conversation covered off various ticketing-related topics, starting with ‘Will Oasis be the biggest concert tour in 2025?’ Which was answered affirmatively, but with the qualifying comment that others may come close given the final number of events.

There then followed remarks about the multi-billions of bots that targeted ‘the biggest on-sale in history’ on 1st October 2024 when Ticketmaster apparently experienced ‘the most demand in history’ for U.S. tour dates by Oasis.

Michael Rapino further described the industrial scale of bots as ‘a professional, multi-billion business trying to capture seats. So, it’s an arms race with us trying to stop them, not let them in the door, not let them hold the tickets”.

Claiming ‘I’m so happy the system didn’t go down. We stopped them. We got it done’, but despite this, access to inventory was subsequently claimed by brokers and scalpers, and this resulted in Oasis tickets re-appearing on secondary marketplaces at higher prices, sometimes even before the pre-sales had officially started i.e. speculative listings.

All this unauthorised activity triggered the comment from Michael Rapino ‘you shouldn’t have a middleman that has nothing invested in the business make any money from it’, and that US Congress should therefore step in and regulate the industry by capping ticket resale prices with a 20 per cent mark-up.

***

Michael Rapino had previously argued that a solution to the threat of secondary ticketing, was to allow primary ticket prices to rise to what the market will bear, capturing the increased revenues on behalf of the event Rights Owners – the artist, attraction, promoter-producer, or sports franchise.

For a company that routinely employs ‘Platinum Tickets’ (https://help.ticketmaster.com/hc/en-us/articles/9782440112017-What-are-Official-Platinum-Seats) and ‘In-Demand’, both unrestrained market-based pricing strategies, as well as enabling Fan-to-Fan Resale (albeit typically with a floor of the original ticket face value – https://help.ticketmaster.com/hc/en-us/articles/9672915828881-How-do-I-sell-tickets) it appears to be a shift in market position that there should now be a pricing cap when 3rd Parties re-sell their tickets.

Does this change of argument suggest a realisation that ticket prices cannot continuously rise without disenfranchising audiences, that excessive profiteering doesn’t play well with all artists, or consumer groups and regulatory authorities, and that this strategy is unsustainable for any form of audience accessibility or development in the live music business.

***

From an international perspective where many territories (including Australia, Denmark, France, Ireland, Italy, and with the U.K government committed to announcing new tougher guidelines) that already have various levels of regulatory intervention in the advertising, pricing, and distribution of tickets, it was interesting to note that apparently federal government intervention is to be (sometimes) welcomed.

Perhaps the unfettered free-market isn’t always the best solution?

***

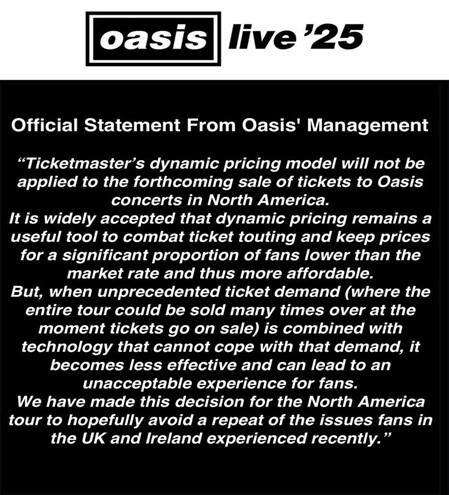

Additional Oasis-related questions that could have been asked include why was ‘In-Demand’ pricing implemented by Ticketmaster for the Oasis Ireland + U.K. dates (allegedly without the knowledge of the band, but arranged by their management and promoters – three of whom were LNE companies – MCD Productions, DF Concerts and Live Nation UK) but not for the U.S.?

Is it as was suggested by Oasis (Management) in their (30th September 2024) X post (https://x.com/oasis/status/1840742234720702774) that the Ticketmaster dynamic pricing solution cannot cope with ‘unprecedented demand’ and that would have led to ‘an unacceptable experience for fans’ in North America.

That Ticketmaster’s ‘In-Demand’ was apparently effective enough for the 31st August Ireland + U.K. onsale, but not robust enough for the U.S.?

And lastly, with the resulting CMA (Competition and Markets Authority) and European Commission investigations into alleged misleading ticket pricing, and/or the deployment of surge-pricing, and/or the alleged breach of consumer protection law, was the Ireland + U.K. onsale a misstep?

***

Separately, as has been asked elsewhere, from a consumer ticket-buying perspective, is there any fundamental difference when paying the bill, between a band touting their own tickets, or purchasing via a secondary marketplace? Is it simply the implied guarantee of access?

***

Later in the Screentime discussion, a passing reference was made towards the lawsuit brought by the U.S. Department of Justice and its now-expanded group of 40 co-plaintiffs against Live Nation-Ticketmaster (for monopolization and other unlawful conduct in violation of Sections 1 and 2 of the Sherman Act) which was dismissed as ‘overaggressive antitrust enforcement’. (Obviously an instance when federal government intervention is not welcomed.)

Michael Rapino fully expected that they would win the case – as though he was going to say anything else.

According to the complaint because of the conduct of Live Nation–Ticketmaster ‘music fans in the United States are deprived of ticketing innovation and forced to use outdated technology while paying more for tickets than fans in other countries … exercises its power over performers, venues, and independent promoters in ways that harm competition. … (and) also imposes barriers to competition that limit the entry and expansion of its rivals’.

However, Michael Rapino defended the company by claiming ‘We (Live Nation) are a 2 per cent margin business, so we must be the dumbest monopoly alive’.

[Smart-alecky cynic’s elsewhere have asked, when has ignorance of the law, or stupidity ever been a defence?]

He further stated, ‘We give 90-plus per cent of the door to the artist, unlike any other business.’

He then explained why the inefficient Live Nation model required vertical consolidation (i.e. Artist Management + Concert & Festival Promotion + Venue Operations + Advertising & Sponsorship + Ticketing) to survive ‘Are we vertical? Of course we’re vertical. Every promoter from history has been vertical because that’s how you pay the bills when you’re 2% margin.’

***

Arguably, the LNE ‘flywheel’ where Live Nation (‘the largest producer of live music concerts’) aspires to breakeven, whilst Ticketmaster (‘the world’s leading ticketing company, 498M tickets, 12,000 clients, 29 countries’) and the Media + Sponsorship / Live Nation For Brands division (‘with 900+ brands, 80M unique monthly visitors,145M names in consumer database’) has driven the growth and global market share.

Or as Michael Rapino acknowledges ‘If I didn’t buy Ticketmaster 12 or 13 years ago … I wouldn’t be here today.’

That without the direct-to-consumer relationship, data-insight and ownership, and commercial engine delivered by Ticketmaster, then Live Nation as a pure-play promoter would not have survived.

***

However, the idea that Live Nation’s low margin promoting business excludes LNE from being viewed as a monopolist is more problematic. Not least because the ticketing and sponsorship are spectacularly cash-positive by comparison.

Essentially the Live Nation Entertainment model thus far has been based around building wealth, not profit.

It’s not so much about the Quarterly P&L statements, so much as Shareholder Value and the implied Market Cap – which currently stands at $26.4Bn (close 17.10.24), from a base of $692.2M in 2005.

This geometric increase in valuation has allowed LNE to now have approx. $7Bn in debt and lease liabilities, which has fuelled the endless series of acquisitions both in the U.S. and internationally.

LNE now arguably dominates the U.S. live music sector (‘owns or controls more than 265 concert venues in North America, including more than 60 of the top 100 amphitheaters in the United States’ – Source: DOJ) and impacts the global industry in a way unrivalled by any competitor (‘connecting over 765 million fans across all of our concerts and ticketing platforms in 49 countries during 2023’ – LNE Form 10-K), already expanding to 52 markets (https://www.livenationentertainment.com/global-sites/) in 2024, and with further international expansion planned.

So, obviously not a ‘monopoly’ but merely a corporation with an ‘enviable market position’.

***

Until next time.

***