TJ Chambers

(c) dreamstime.com

At the recent 53rd annual J.P. Morgan Global Technology, Media and Communications Conference (https://www.jpmorgan.com/about-us/events-conferences/technology-media-communications-conference) Joe Berchtold, CFO and President Live Nation Entertainment informed the assembly that despite expectations of a global economic slowdown this year, alongside the uncertainty of on/off U.S. tariffs and weaker consumer confidence (Conference Board, Present Situation Index which fell in April 2025 to a five-year low – https://www.conference-board.org/topics/consumer-confidence), he stressed that his company wasn’t experiencing any slowdown in the demand for live music.

The reason being the vibrant post-pandemic appetite for the live spectacle especially in its overseas markets, with Berchtold stating ‘The majority of growth has come from international over the past several years and the majority of growth will come from international this year’.

This reflects the scale of multiple previous acquisitions (founded 2005, with over 47 notable transactions to date, of which ten were domestic and the rest international across 16 different countries) meaning that Live Nation (‘the world’s largest producer of live entertainment’) now operates in over 45 countries.

This global scale and reach was clearly illustrated by the statement from Berchtold that Live Nation has now sold more than 100M tickets YTD, up from the 95M reported 1st May in the Q1 2025 Earnings Release (https://www.livenationentertainment.com/2025/05/live-nation-entertainment-reports-first-quarter-2025-results/) and more than the 98M sold by Live Nation in the full year 2019 (https://investors.livenationentertainment.com/sec-filings/annual-reports/content/0001335258-20-000028/lyv-20191231.htm).

Glocalisation

This expansive international promoter platform enables artists to extend tours beyond the traditional North American and Western European markets to now include the Middle East and Africa, Asia-Pacific, and Latin America, subject to the availability of suitable arenas and stadiums, and local cultural or political restrictions, but driven by the increasing disposable income of the global middle-classes who desire access to the latest pop phenomena or tier #1 heritage acts alongside their local stars reflecting the ongoing ‘glocalisation’ of music consumption (Music markets are ‘glocalising’ — and the English-speaking world better get used to it, Will Page, 3rd June 2023 –https://www.ft.com/content/308407e3-26a2-4ae8-a64e-3e4cb7eee9ab).

As noted by Berchtold, ‘Artists that would have historically been regional, are now themselves going global’ (Webcast: https://investors.livenationentertainment.com/news-events/ir-calendar/detail/6351/j-p-morgans-53rd-annual-global-technology-media-and), for example Bad Bunny whose Debí Tirar Más Fotos World Tour has already sold more than 2.6 million tickets for 54 stadium shows in 18 countries (https://news.pollstar.com/2025/05/16/bad-bunnys-global-tour-shatters-records-sells-over-2-6m-tickets/).

This international expansion of concerts, tours and residencies with the associated focus on new venues to provide a local performing platform (current Live Nation building projects include Bogotá, Helsinki, Lagos, Lisbon, and Mexico City as well as pop-ups in München and Toronto), each positively reinforces the global network, and is what some have referred to as ‘supply creating its own demand’ (obscure economics reference to Jean-Baptiste Say / John Maynard Keynes).

Ticketing Management

The combination of a new worldwide network of venues for global tours whilst also enabling local acts to tour regionally and/or internationally, coupled with the deployment of yield management tools for the most in-demand seats is driving the growth in Live Nation revenues – i.e. an increased global number of concerts, coupled with the focus on the maximisation of ticket revenues, alongside event-related volume-driven F&B, Hospitality, Parking etc., and associated corporate advertising and sponsorship (preferably not event-related as that may then be part-captured by the artist).

The ‘smarter pricing’ is driven by data analytics narrowing any difference between the primary / ‘original issuance’ ticket price, and what the unauthorised secondary marketplaces are charging.

(Albeit from a consumer perspective is there much difference between an overpriced ticket bought from official channels, or unofficial – it’s still an expensive purchase.)

Berchtold stated that the ability to extract more for in-demand sections coupled with lower-rate increases for the back-of-the-house, and the implementation of ‘all-in pricing’ (the law of unintended consequences actually means ‘all-in pricing’ discretely blurs who gets what whilst presenting the final purchaser cost at the beginning of the transaction) with improved communication for customers whilst in online queue’s or explaining opaque T&C’s is a service aspiration for Ticketmaster.

He stated that eventually the ticketing platform will be seen ‘as a utility, as a service that is provided efficiently and doesn’t have an agenda and is not trying to do anything nefarious’ (https://www.musicbusinessworldwide.com/live-nation-has-already-sold-100m-tickets-in-2025-so-far-compared-to-98m-sold-in-all-of-2019/).

Amongst others, the U.S. Department of Justice, Federal Trade Commission, various U.S. State Attorney Generals and other regulators may believe otherwise, whilst the speculators of the stock markets are currently very happy with LNE, up 1,250% since its 2005 launch.

Live Nation Entertainment Inc.

(Market Cap: $33.93Bn)© Google (15.05.25)

***

And what of the other live entertainment and ticketing conglomerates. Is live music still ‘a volatility resistant asset class?’

(*Disclaimer: this blog post is purely for educational / entertainment purposes only and any opinions expressed should not be construed in any way as investment advice. For that you need to consult with an expert.)

***

Volatility Resistant Asset Class

Well, that certainly appears to be the case for CTS Eventim with its stock up 3,469% (15.05.25) since its launch on the Frankfurt stock exchange in 2000.

CTS Eventim AG & Co KGaA

(Market Cap: €10.72Bn) © Google (15.05.25)

Albeit the stock experienced a slight wobble following its Q1 2025 announcement (Successful start to 2025, 21.05.25 – https://corporate.eventim.de/en/news-media/news/cts-eventim-successful-start-to-2025/0ffb88ed-f74a-4d4b-bfbd-82c49863faf2) when it confirmed that its consolidated revenues were up 22% and EBITDA was up 8.9% Y-O-Y.

The market initially expressed its disappointment with an initial 11% correction, but the stock recovered to only book a 5.6% down for the week. Go figure.

***

Sphere Entertainment is a U.S.entertainment hold-co that owns the Sphere, Las Vegas as well as the New York-based MSG Networks a regional cable and satellite television network.

The company was originally formed in 2020 as Madison Square Garden Entertainment, a spin-off of the non-sports assets of the Madison Square Garden Company. In 2023, Madison Square Garden Entertainment spun off its live events business as a new company under the same name, and the original MSG Entertainment was renamed Sphere Entertainment. You follow?

Anyway, the Sphere cost approx. $2.3Bn to build and the company now has a market cap of $1.35Bn – go figure.

Sphere Entertainment Co

(Market Cap: $1.35Bn) © Google (15.05.25)

***

The secondary marketplace Vivid Seats is having a difficult time, claiming the resale of sports ticketing continues to deliver, but demand via its marketplace for concerts is weak – proof positive that the primary market and in particular Ticketmaster is better equipped to manage resale and/or dynamically priced inventory than it used to be?

Anyway, with a market cap of $404M is it inevitably a target for someone who thinks they can do a better job?

Vivid Seats Inc.

(Market Cap $403.9M) © Google (15.05.25)

***

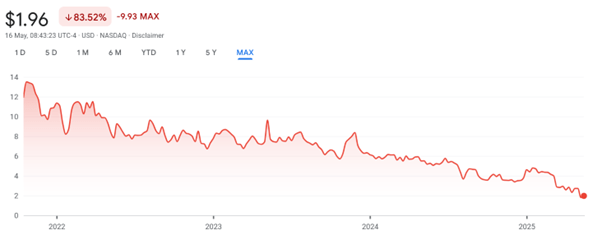

And then there is Eventbrite. At the time of its IPO in 2018, analysts suggested a market cap of $1.8Bn was not unrealistic, and a disruptive tech-driven entrant to the ticketing sector seemed inevitable.

A series of acquisitions, including the $200M+ Ticketfly debacle (https://www.eventbrite.com/blog/ticketfly-moving-eventbrite/), a painful experience with concert and festival promoter advances, and then management’s focus on the long-tail of meetings, events and experiential activities all means that the company is arguably no longer a meaningful B-2-B-2-C platform for the live music industry.

Eventbrite Inc.

(Market Cap: $222.46M) © Google (15.05.25)

***

Stop Press:

As usual whilst compiling this post (in-between attempting to support my clients and their ongoing projects, and preparing for this year’s #UltraChallenge 100Km London2Brighton charity walk – https://www.justgiving.com/page/tj-chambers-1735421257242) there is another noteworthy news item, namely:

Live Nation Entertainment Elects Richard Grenell to Board of Directors, 20.05.25 – https://www.livenationentertainment.com/2025/05/live-nation-entertainment-elects-richard-grenell-to-board-of-directors/

This PR immediately triggered a series of news articles and blog posts, so rather than add I thought I would simply list a couple:

Live Nation Names Trump Ally to Board of Directors Amid DOJ Probe, Winston Cho, 20.05.25 – https://www.hollywoodreporter.com/business/business-news/live-nation-names-trump-ally-board-directors-amid-doj-probe-1236223254/

Live Nation Names Trump Crony Ric Grenell to Its Board of Directors, Tomás Mier, 20.05.25 – https://www.rollingstone.com/music/music-news/live-nation-names-ric-grenell-board-of-directors-trump-ally-1235344483/

Grenell Joins Live Nation Board, Bob Lefsetz, 21.05.25 – https://lefsetz.com/wordpress/2025/05/21/grenell-joins-live-nation-board/

Kennedy Center Head Richard Grenell Joins Live Nation Board Of Directors, Katherine Bassett, 21.05.25 – https://www.musicbusinessworldwide.com/kennedy-center-head-richard-grenell-joins-live-nation-board-of-directors/

So maybe next time I’ll comment about the fact that Live Nation and AEG are now facing a criminal investigation over alleged Covid-era collusion.

DOJ Probes Live Nation, AEG Over Covid-Era Refund Collusion, Josh Sisco + Lucas Shaw, 15.05.25 – https://www.bloomberg.com/news/articles/2025-05-15/doj-probes-live-nation-aeg-for-collusion-on-covid-era-refunds

DOJ Investigating Live Nation, AEG Over COVID-Era Refund Strategies, Ethan Millman, 15.05.25 – https://www.hollywoodreporter.com/business/business-news/doj-investigating-live-nation-aeg-covid-refund-policies-1236218806/

But it’s just so difficult to keep up.

Until next time.