TJ Chambers

‘…the leading independent live entertainment tech platform’

On the 4th of June 2025, Fever ‘the leading global live entertainment discovery platform’ (https://feverup.com/en/) announced that it had secured an additional $100M funding: Fever Secures $100m, Strengthening Its Position as the Leading Independent Live Entertainment Tech Platform, 04.06.25 (https://newsroom.feverup.com/en-US/250714-fever-secures-100m-strengthening-its-position-as-the-leading-independent-live-entertainment-tech-platform) to fuel its continued growth in music and sports, two verticals where the company claims it has gained significant traction over the past year.

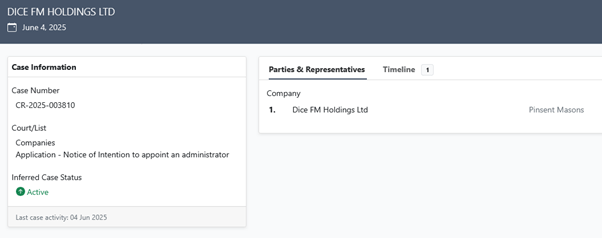

Elsewhere, but also on the 4th of June, DICE (https://dice.fm/) the app for ‘basement gigs or club nights, massive festivals or sweaty raves’ separately announced their intention to file for administration.

https://caseboard.io/cases/b7df9b51-3847-4a1d-bd10-25b290b36891

When a company goes into administration, they are entering a legal process where the management and control passes from the company directors to an appointed administrator. The aim is to temporarily free the company from any creditor enforcement actions, enable new financial and operational restructuring plans, to potentially rescue a viable business that is insolvent due to cashflow problems, or engineer a sale of the business or its assets to a third party.

Daniel Woolfson claimed (Nightlife crisis sees British ticket app snapped up by US rival, Daniel Woolfson, 06.06.25 –https://www.telegraph.co.uk/business/2025/06/06/dice-fm-us-rival-poor-britain-nightlife/) that ‘a source close to the situation said Dice FM had taken the step as a precaution’.

However, none of the fan-boy media in live entertainment appeared to notice this latest setback in the development of DICE, but then coverage of the company has long been highly favourable focussing more on the slick app UX with QR codes and a ‘waiting list’ facility, whilst noting that it wasn’t the big, bad, unlikeable and dominant conglomerate that everyone loves-to-hate (Ti*k*tma*t*r), with scant regard to its actual financial performance, market size or the technical capabilities of its ticketing solution (with its rudimentary reserved seating facility, and an apparently limited ability to manage discounted tickets or donations etc.).

This critical unawareness or laziness is what Richard Kramer and Will Page have previously identified as ‘sycophants and stenographers’ (https://www.bubbletroublepodcast.com/sycophants-and-stenographers/) where those masquerading as industry commentators or analysts ‘praise as opposed to appraise’.

However, before anyone had fully digested the news of this latest Fever fundraise (which meant that it had successfully secured approx. $527M investment funding since 2014), the very next day it announced the acquisition of DICE: Fever and DICE Join Forces to Build a Live Entertainment Tech Powerhouse, 05.06.25 (https://newsroom.feverup.com/en-US/250537-fever-and-dice-join-forces-to-build-a-live-entertainment-tech-powerhouse).

‘… to build the world’s leading independent live entertainment tech platform’

Financial details of the transaction weren’t disclosed, but both parties stressed the industry-disruptive but consumer-friendly nature of their (combined) business model.

Fever co-founders Ignacio Bachiller, Alexandre Perez and Francisco Hein claimed: ‘Together, we are strengthening our position as the leading global tech player for culture and live entertainment’. Continuing, ‘We are on a joint mission to put fans first and provide our partners with the best and most innovative tools … to elevate the live music experience – making it more accessible, more personalised, and ultimately more impactful for fans, artists, and venues alike.’

DICE founder and CEO Phil Hutcheon said ‘From our personalized Discover feature to our upfront, all-in pricing and Waitlist feature, we’ve always put fans first. That same ethos is what we’ve found in Fever. Joining forces allows us to scale even faster. Reaching new cities, helping sell out more shows, and delivering the seamless experience fans expect.”

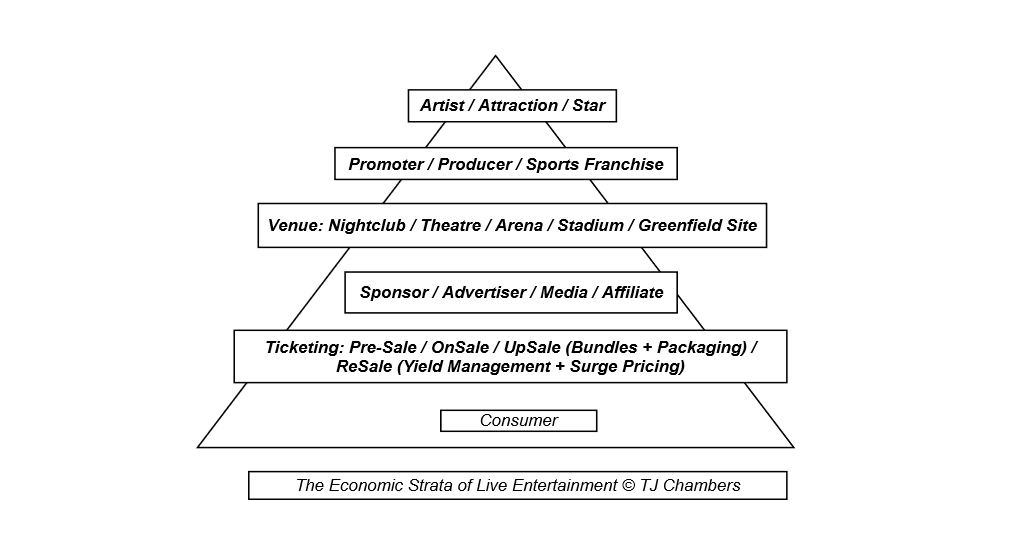

This fans-first statement is what essentially differentiates both companies from the mainstream supply side-led ticketing industry where service providers typically enable event box office and ticket manifest management, with incremental retail, marketing and distribution of inventory on behalf of clients to the end-user; whether attendee, fan, patron, spectator or supporter.

Within live entertainment the hierarchal economic relationships, mean that the (B-2-B) ticketing system providers and (B-2-C) retail agencies acquire access to inventory (and thus continue to grow their own business) by incentivising the supply of ticketing (through a mixture of technologies and services alongside rebates, commissions and other fiscal contributions) whilst passing as much of their operational costs as possible onto the end-user.- hence the ubiquitous use of ticketing service fees etc.

The claims by both DICE and Fever to put the fan ‘first’ whilst apparently uniquely (?) employing modern, cutting-edge technologies and services such as: mobile apps with event discovery and curation; integration to music streaming platforms enabling recommendations based on personal playlists; all-in pricing (increasingly a legal requirement in many territories); animated QR codes (restricting unauthorised duplication); sophisticated data analytics; and the championing of new music’s or immersive experiences, where the traditional ticketing retailers have less developed networks, has all combined to persuade some observers that they are indeed the future.

But a more sober assessment of the economic sustainability of these companies may reveal a less complimentary perspective.

When DICE launched in 2014 it grandly announced that ticket purchasers would pay no service fees with the tagline: ‘Best Gigs. No Booking Fees’ (No-booking-fee app for gigs is launched, Miranda Bryant, 19.09.14 – https://www.standard.co.uk/news/london/nobookingfee-app-for-gigs-is-launched-9743483.html).

This advertising strapline was quietly dropped in 2017 before reverting to the classic ticket retail model of ticket face value + service fee in 2018 (Mobile ticket retailers DICE have officially introduced booking fees, Helen Meriel Thomas, 16.02.18 – https://www.nme.com/news/music/dice-officially-introduced-booking-fees-2243608).

The reason for this shift was because of the cost of business – staff, rental, rates, heating, computers and office supplies, as well as being an internet-based company requiring bandwidth, servers, engineers and coders etc. alongside brand advertising and promotional campaigns, oh, and the rebates required by the various inventory providers (whether artist, promoter or venue etc.) for each and every ticket sold by DICE.

So, by not charging the ticket purchaser any booking fees (to cover their own costs as well as any associated ticket commissions) the company was losing money for every ticket it sold.

And the more tickets it sold, the more it required additional funding, and so between 2014-2023 DICE raised approx. $238M over eight rounds.

At the time of its two major investment rounds in 2021 of $122M (UK ticketing platform Dice raises $122m in funding, 27.09.21 – https://www.iqmagazine.com/2021/09/uk-ticketing-platform-dice-122-million-funding/) led by Softbank Vision Fund, and then in 2023 of $65M (DICE raises $65m from investors including Matt Pincus, Willard Ahdritz and more, Murray Stassen, 23.08.23 – https://www.musicbusinessworldwide.com/dice-raises-65m-from-investors-including-matt-pincus-willard-ahdritz-and-more/) the company was then valued at approx. $400M and employed 427 people, before then embarking on three rounds of redundancies.

The reason for this downsizing was simple, by then DICE was heavily losing money – approx. $1M per week over a two-year period (2022-2023).

But don’t take my word for it, go to Companies House (https://find-and-update.company-information.service.gov.uk/company/08905651) the UK Government database.

Y/E 31.12.19 < £9.8M > (Equivalent) < $13.2M >

Y/E 31.12.20 < £13.8M > (Equivalent) < $18.86M >

Y/E 31.12.21 < $29.4M >*

(*following corporate re-org to DICE FM Holdings and restatement of accounts)

Y/E 31.12.22 < $50.3M >**

(**posted 06.06.24, i.e. six months late for statutory filing)

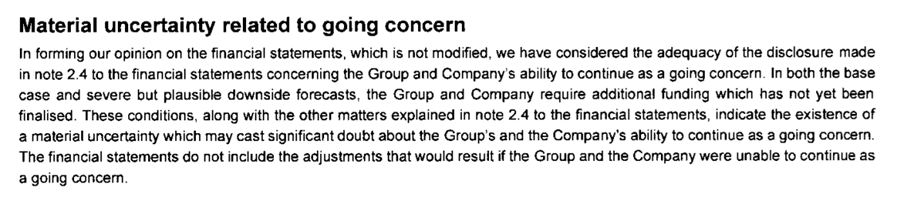

Also noted in the 2022 accounts is the statement by the Independent Auditors:

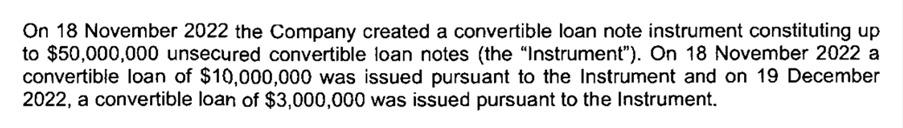

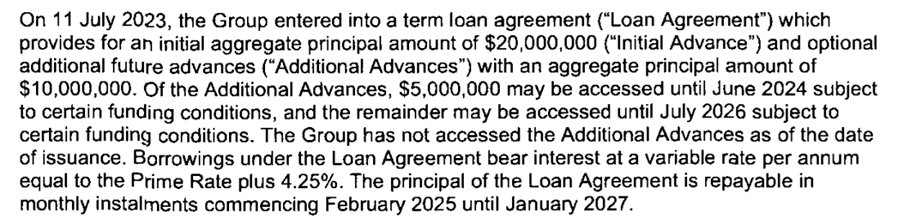

To address this the company created a convertible loan note:

And then stated in the 2022 Post Balance Sheet Events:

So, essentially the company was then (2023) badly losing money, had issued a debt convertible note, entered into a loan agreement, and was already seeking new additional financing.

Whilst the 2021 and 2023 fundraises implied an enterprise valuation of ‘hundreds of millions’ by the summer of 2024 the figure was closer to < $100M due to the scale of losses.

To make matters worse Softbank, one of its biggest investors, was apparently keen to sell its stake (Why Live Music Became the Hottest Market for Media Deals, Lucas Shaw, 14.07.24 – https://www.bloomberg.com/news/newsletters/2024-07-14/why-live-music-became-the-hottest-market-for-media-deals).

Allegedly DICE then met with (at least) one of its direct competitors to discuss a sale.

In November 2024 (11.11.24) DICE confirmed a Supplemental Debenture* i.e. a charge against the company by Ocean II PLO LLC a business entity based in Menlo Park, CA. – satisfied 12.06.25 following the transaction with Fever.

A second charge by Ocean II PLO LLC was created in December 2024 (19.12.24) – also satisfied 12.06.25 following the transaction with Fever.

And lastly, a third charge by Ocean II PLO LLC was created in April 2025 (21.04.25) – also satisfied 12.06.25 following the transaction with Fever.

Post transaction, only one charge against DICE remains outstanding and that is with HSBC Innovation Banking (Charge Code: 0890 5651 0011)

(*A debenture is a loan agreement in writing between a borrower and a lender that is registered at Companies House. It gives the lender security over the borrower’s assets.)

As of today (13.06.25) the 2023 Annual Accounts have not been published – despite the filing date being the end of December 2024.

So why would Fever want to acquire DICE given the scale of its ongoing losses, whereas (allegedly) other direct ticketing competitors passed?

It could be argued that it presents Fever with access to some incremental ticket retail contracts (with both promoters and some venues) and potentially strengthens its music-related market share in key international cities in the UK, US, Canada, France, Germany, India, Italy and Spain.

But now Fever will have to consolidate its tech stack to a single ecommerce and experiential marketing solution and integrate the two company’s operations, which will inevitably mean post-transaction the drive to achieve cost-savings and synergies i.e. redundancies and (further) downsizing.

In the $100M fundraise note (04.06.25) Fever stated: ‘This financing highlights a remarkable 2024, during which the company achievedover 20x revenue growth from pre-pandemic levels, while maintaining full-year EBITDA profitability.’

Taking on a loss-making entity like DICE will inevitably add stress to its ability to maintain EBITDA profitability.

Whilst the growth in Fever revenues is part-explained by the evolution of its business model since the pandemic: initially being a curated event discovery app attracting affiliate fees (a small proportion of ticket service fees); then becoming a marketing and promotions partner for selective events (and thus sharing a higher proportion of service fees and/or a small part of the stated ticket face value); then developing into a fully-fledged promoter in its own right – ‘Fever Originals’ – specialising in themed immersive events such as candlelight string quartets in churches, rooftop movie nights, ‘foodie favourites’, ‘romantic date ideas’ etc.

Additionally, given the undisclosed (but obviously discounted) price paid for DICE and the positive bounce the acquisition will have given to Fever’s investors and industry commentators what’s not to like?

The deal will inevitably drive-up revenues – and for many that is the KPI.

(Note to re-read Charles Dickens ‘David Copperfield’ and Wilkins Micawbers’ note about expenditure exceeding income.)

***

I should state at this time that I have no issues with Dice or Fever, their executives or business operations – this is merely an opinion piece, and I apologise for any inaccuracies contained within.

Comments welcomed via the usual channels.

Until next time.