TJ Chambers

(c) dreamstime

There has been a lot of chatter over the last couple of years about ‘superfans’.

How the identification and then engagement with, i.e. monetisation, of a subsection of the overall audience for music will apparently deliver a new and important revenue stream for both the recorded and live industries.

So, each sector is focussing on the maximisation of earnings from a subset of its pre-existing audience, as they believe, much like the adoption of dynamic pricing, that the ‘squeezing’ of more-from-the-same is an easier exercise than attempting to grow the overall market.

The theory being that superfans don’t just purchase the recorded music output (whether physical products such as Album, CD, or the Box Set compilation of outtakes, alternate versions and live tracks, with associated digital downloads), or listen via music streaming platforms (whether Amazon Music Unlimited, Apple Music, Deezer, Spotify, or Tidal etc.), or engage with short or long-form music-based social media (via Facebook, Instagram, Snapchat, TikTok, WeChat, or YouTube etc.), or join official fan clubs or unofficial fan forums, buy legitimate merchandise or bootleg swag, or queue online to purchase tickets, and/or VIP bundles and packages for their idols, but all of that, and more.

So, both the recorded and live music industries perceive this sub-section of the total audience as guarantors of their continued corporate growth.

***

Recorded And Live Music – Recent Fortunes

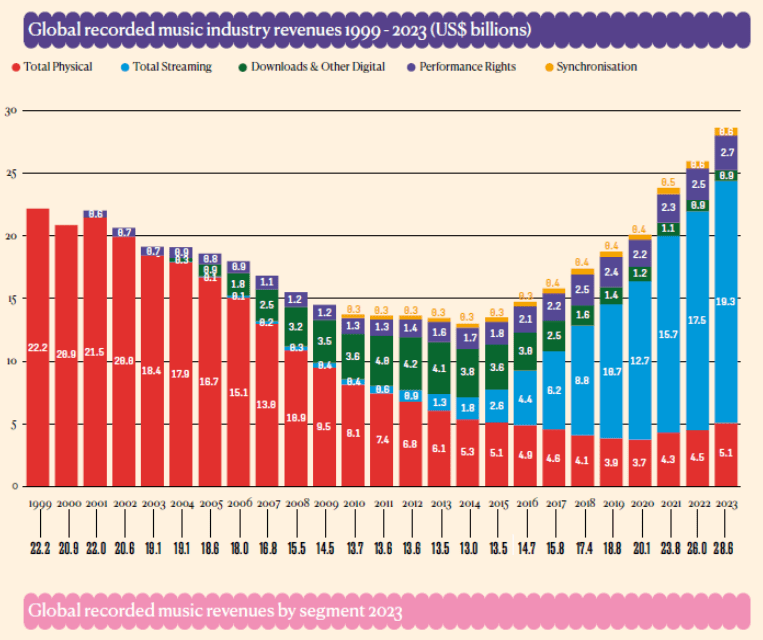

From a peak in 1999, the recorded music industry suffered significant losses following the collapse of vinyl and CD-fuelled revenues, and then with the disruption of file-sharing.

The eventual relaunch via streaming services has especially revived the fortunes of the major labels and their various subsidiaries (BMG Rights Management; Sony Music Entertainment including Columbia, and RCA; Warner Music Group including Atlantic; Universal Music Group including Capitol, Interscope, and Republic etc.), albeit that the revenues are not necessarily evenly distributed with artists often complaining about low per-stream payouts.

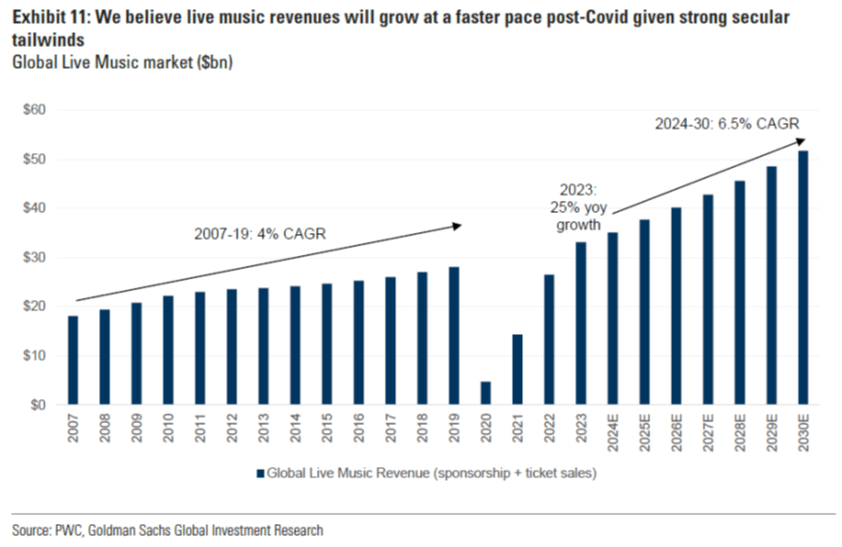

During the same period the live music sector has also become increasingly dominated by major international congloms (AEG-AXS, BookMyShow, CTS Eventim, DEAG, Live Nation-Ticketmaster, TEG-Ticketek etc.) with live concerts, festivals, residencies, and tours having become the primary source of revenue for artists, despite the COVID-19 pandemic temporarily pausing live events (with some experimentation via live-streamed performances etc.), but has subsequently experienced a massive resurgence of IRL monetisation since.

The IFPI (International Federation of the Phonographic Industry), the organisation that represents the interests of the recorded music industry worldwide, in its Global Music Report, State of the Industry 2024 (https://globalmusicreport.ifpi.org/) described the global recorded music market as worth $28.6 Bn in 2023, with streaming 67.3% of that total.

(C) IFPI

In the same report the IFPI claims that record companies are the ‘leading investors in music’ with $7.1Bn annually invested in 2023 of which $3.9Bn was devoted to A&R, and with an additional $3.2Bn invested in the marketing of artists.

Separately, Live Nation the world’s largest music promoter (with over 71M tickets sold in 2024) claims that it ‘paid over $13Bn of artist costs in 2023 alone’ and that ‘more than 90% of ticket sales (less show costs) for Live Nation shows go directly to artists’ (https://www.livenationentertainment.com/facts/).

Whilst there is no authoritative global live music report, Goldman Sachs in ‘Music in the Air’ (01.05.24) reported that the global live music revenues (including event sponsorship and ticketing) in 2023 equated to $33.1Bn (https://www.goldmansachs.com/pdfs/insights/pages/music-in-the-air–focus-on-monetisation,-emerging-markets-and-ai–updating-global-music-industry-forecasts-f/music-redaction.pdf).

© PwC / Goldman Sachs

To summarise, the global recorded music market (excluding publishing and sync) in 2023 equalled $28.6 Bn, whilst the global live music sector delivered $33.1Bn.

***

The Targeting of Superfans

In July 2023, Goldman Sachs stated that there was ‘a $4.2Bn addressable market opportunity for superfan monetization’ (Music streaming services are on the cusp of major structural change – https://www.goldmansachs.com/insights/articles/music-streaming-services-are-on-the-cusp-of-major-structural-change) which they updated in May 2024 to $4.5Bn (Music in the Air – https://www.goldmansachs.com/pdfs/insights/pages/music-in-the-air–focus-on-monetisation,-emerging-markets-and-ai–updating-global-music-industry-forecasts-f/music-redaction.pdf).

Also in July 2023, Luminate revealed in their midyear report that ‘15% of the U.S. general public can be categorized as superfans’ (https://luminatedata.com/reports/midyear-music-industry-report-2023) and that ‘superfans spend +80% more per month on music activities than the [average] U.S. music listener’.

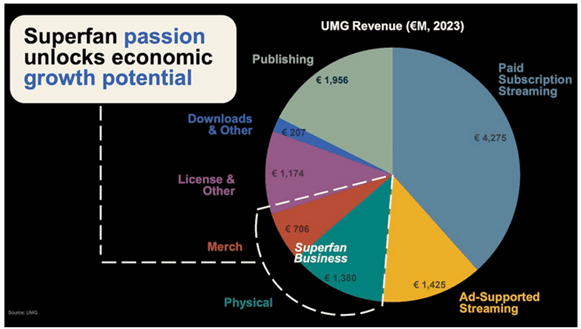

In January 2024, Sir Lucian Grainge Chairman & CEO of Universal Music Group (UMG) stated in an internal note to staff, ’The next focus of our strategy will be to grow the pie for all artists, by strengthening the artist-fan relationship through superfan experiences and products’. This would apparently be achieved by building in-house e-commerce and D-2-C operations to enable artists to ‘create experiential, commerce and content offerings for their fans’.

In September 2024, at the UMG Capital Markets Day at Abbey Road Studios, Grainge highlighted the segment of its business attributable to superfans in 2023 (which UMG defined as merchandise and physical sales) which totalled €2.08Bn – or 18.7% of overall revenues.

(c) UMG

In February 2024, Warner Music Group (WMG) CEO Robert Kyncl took part in the Web Summit technology conference in Qatar, and in a session entitled ‘The Artist, the CEO, and the Future of Music’ outlined its own ‘superfan app’ to enable direct-to-superfan experiences.

Claiming that ‘both artists and superfans want deeper relationships, and it’s an area that’s relatively untapped and under-monetized’.

The WMG app strategy is similar to Hybe Corporation’s (https://hybecorp.com/eng/main) Weverse app (https://weverse.io/), which boasts over 10 million monthly active users, and differs from UMG’s approach, which focuses on enhancing the superfan experience within existing streaming services.

Live Nation has been consistently dismissive of the streaming platforms attempts to deliver a compelling superfan offering without access to concert ticket inventory, suggesting they and their record label partners lack sufficiently valuable content of their own to drive value.

But they are obviously happy to offer special presale access to those platforms and their ‘super-tier’ streaming subscribers, albeit on their terms.

And no-one needs reminding that Amazon closed its ‘Amazon Tickets’ venture in 2018, or that Spotify more recently tested selling tickets directly on its platform in 2022 via the now-defunct ‘Spotify Tickets’ brand.

***

Super(exploited)fans?

Unless the recorded music sector therefore develops its own D-2-C channels, whether fan clubs, or specialist label-branded retail outlets etc. it will continue to be disintermediated by middlemen such as 3rd party wholesalers, distributors or retailers.

Additionally, with the dependence on streaming (accounting for 67.3% of global revenues in 2023), as the global streaming market matures with income from the newer international territories unlikely to offer the same level of Average-Revenue-Per-User (ARPU) as the established North American market, and with the need to avoid any subscription fatigue or price-sensitivity, there is an increased focus on new services, for example ad-supported channels with lower subscription charges (whilst also delivering incremental sponsorship and branding opportunities for the platforms), or premium ‘enhanced audio’ offerings.

With the utilisation of the internet and digital marketing tools, many businesses have successfully bypassed traditional distribution channels to directly reach their own customers.

Will the recorded sector therefore be able to successfully migrate from a historical B-2-B model to offer a contemporary B-2-C marketplace, combining content, discovery, engagement and retail?

Will the recorded music industry be able to bundle the right product offering to its superfans?

By comparison, the live music sector is trumpeting record revenues, with double-digit growth expected for the next decade following further territorial expansion for the major operators in the Gulf States, South America, Africa and the Pacific Rim, with seemingly every international capital city proclaiming a new arena or stadium development targeting the global touring circuses of rock and pop. And at prices comparable, if not exceeding the traditional U.S. or European heartlands.

Additionally, there is a continued appetite for the unique experience of in-person entertainment, with a global middle class able and willing to pay for a range of premium-priced ticketing ranging from front-row seats, soundcheck access, meet-and-greets, and/or VIP packages.

For the live sector the superfan offering i.e. premium ticketing, has been part of the overall event planning for some time, albeit for some the debate is now more concerned about the cost of access, audience engagement, development or retention, and whether the high prices may now be discouraging some audiences.

***

Comments welcomed.

Until the next time