TJ Chambers

© dreamstime.com

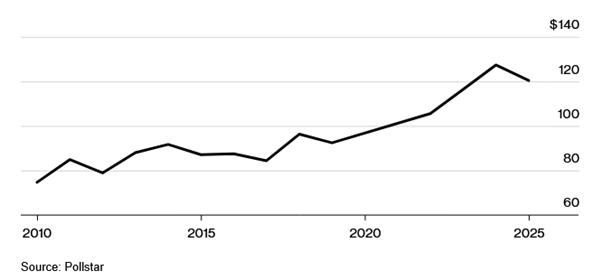

Earlier this week Lucas Shaw of Bloomberg reported that according to Pollstar data, the average price of the Top 100 Tours Worldwide has fallen by about 6% from last year. And that is the largest amount in over a decade, excluding the pandemic (Concert Ticket Prices Are Falling For the First Time in Years, Lucas Shaw, 16.06.25 – https://www.bloomberg.com/news/newsletters/2025-06-16/concert-ticket-prices-are-falling-for-the-first-time-in-years).

Does this actually mean price deflation for tickets … let’s unpick that a little.

Firstly, the source of this data needs to be understood i.e. it’s an aggregation of ticketing sales figures ‘as reported to Pollstar’. So, it’s not representative of any official industry or regulatory filing, but more typically data supplied from artists and promoters who want to trumpet their good news (Sellout! Record Revenues! Tour Extended!) rather than explain the more negative event postponements, under-capacity sales, discounting or no-shows.

Further as previously explained (Sycophants And Stenographers* (2024) RePost – https://tjchambers.blog/2025/01/04/sycophants-and-stenographers-2024-repost/), there is also the ‘political’ aspect of data supplied to Pollstar given its ownership i.e. a wholly owned subsidiary of Oak View Group (https://www.oakviewgroup.com/), which means it can therefore experience some tension with competing venue operators such as AEG (https://aegworldwide.com/divisions/facilities). All of which may, part explain, the consistent underreporting of ticketing activity at The O2, the ‘World’s Busiest Arena’, or not.

So, the average price fall of 6% is for the Top 100 Tours Worldwide ‘as reported to Pollstar’.

Average Ticket Price – Top 100 Tours Worldwide (2010-25)

© Bloomberg / Pollstar

But even then, the term ‘average’ is masking a lot of potential issues about reported ticket prices – for example how to accurately report event sales and revenues for the mix of Standard / GA, Front-Row Seats, Premium VIP + Hospitality, and/or Platinum / ‘In-Demand’ Tickets – even when there is the willingness to be transparent.

PRS and Ticketing

Additionally, the PRS (https://www.prsformusic.com/) recently alleged that Live Nation may not always account for the value of VIP tickets and packages when calculating how much should be paid to the collection agency – PRS files lawsuit against Live Nation over VIP ticketing saying live giant shows “disregard” for creators rights to proper payment, Sam Taylor, 15.11.24 – https://completemusicupdate.com/prs-files-lawsuit-against-live-nation-over-vip-ticketing-saying-live-giant-shows-disregard-for-creators-rights-to-proper-payment/.

It’s the economy stupid …

Further, Bob Allen in Pollstarreports (Mid-Year Business Analysis: 2025’s Mixed Results, Bob Allen 13.06.25 – https://news.pollstar.com/2025/06/13/mid-year-business-analysis-average-gross-revenue-ticket-sales-up-significantly-overall-numbers-down-coldplay-shakira-kendrick-sza-have-top-tours/) that their data also reveals that average show gross of the Top 100 Tours ($1.71M) and average ticket sales volumes (14.2K) are up significantly 24.9% + 32.1% Y-O-Y respectively, in part due to the increased mix of US and international stadium shows in the sample (particularly in Latin America, Australia, the Middle East and Asia).

The article continues that the reported 6% fall in average ticket price may reflect ‘2025’s uneven economic conditions marred by trade wars, a volatile stock market, shaky consumer confidence, inflation and mixed employment reports.’

Additionally, in a Y-O-Y comparison of Top 5 Tours Worldwide to H1 2024, when artists such as Madonna, Bad Bunny, Luis Miguel, U2 and Karol G performed approx. 221 times, this year Coldplay, Shakira, Kendrick Lamar/SZA, the Eagles and SEVENTEEN have a combined show count of 88.

The point being that there is just less of the tier #1 artist tours so far this year, and they are typically the ones more able to monetise their audiences.

So, tour seasonality and the mix of artists have also had an impact on the reported average ticket price.

And that will change again later this year.

Beyoncé , Cowboy Carter Tour

For example, Beyoncé has just finished six-nights of her ’Cowboy Carter Tour’ at Tottenham Hotspur Stadium. (Beyoncé beats her own record with six-night run at Tottenham Hotspur Stadium, Andre Paine, 17.06.25 – https://www.musicweek.com/live/read/beyonc-beats-her-own-record-with-six-night-run-at-tottenham-hotspur-stadium/092150).

These Live Nation promoted concerts were attended by approx. 275K fans and grossed over £45M ($60.5M), that’s an average of £164 / $220 per ticket.

No wonder Michael Rapino in the recent LNE Q1 2025 Earnings Call (First Quarter 2025 Earnings Conference Call Transcript, 01.05.25 – https://d1io3yog0oux5.cloudfront.net/_8987d045a3179a5b641ce2f7dcaa1212/livenationentertainment/db/670/6349/transcript/1Q%2725+Transcript_FINAL.pdf) stated with regards to consumer pullback, ‘We haven’t felt it at all yet.’

He continued, ‘any data we have right now up until last week, whether it’s a festival onsale or a new tour or show that went onsale, complete sell-through and strong demand and beating last year’s numbers. So, we haven’t seen a consumer pullback in any genre, club, theatre, stadium, amphitheatre. We haven’t seen it all happen yet.’

***

At the time of writing this post, the ONS (Office for National Statistics – https://www.ons.gov.uk/) reported that UK retail sales volumes had dropped by 2.7% in May 2025 (UK retail sales record biggest monthly drop since 2023, David Milliken, 20.06.25 – https://www.reuters.com/business/retail-consumer/uk-retail-sales-fall-may-2025-06-20/), and separately the FT reported that UK credit card borrowing costs have soared to the highest levels in nearly two decades (UK credit card borrowing costs at a 19-year high, Maisie Grice, 20.06.25 – https://www.ft.com/content/02f92090-67a4-4195-9d5b-b065e681714b), so perhaps the squeeze on the advance purchase of high-priced tickets soon-comes?

It’s obviously already being experienced in the grassroots, emerging stages and provincial markets (where margins have always been tight) for artists, promoters, festivals and venues – see the regular updates from the MVT (https://www.musicvenuetrust.com/), the NTIA (https://ntia.co.uk/) and UKHospitality (https://www.ukhospitality.org.uk/) amongst others,

***

And in other news.

Fever Acquires…

Many thanks to all of you who read last week’s post (Fever Acquires DICE … And in other news 13.06.25 – https://tjchambers.blog/2025/06/13/fever-acquires-dice-and-in-other-news-13-06-25/), engagement was far beyond the usual level of interest, I guess the topic struck a chord.

There were however a couple of comments and queries that I’d like to address.

An analysis or understanding of ticketing

The live entertainment media (whether print, online, podcast, or social) rarely exhibits any interest beyond republishing corporate PR (typically with a file photograph of the fashionably unshaven CEO standing in front of exposed brickwork with metal frame windows, meaningfully looking towards the future), unquestioning in their rebroadcast of excited, disruptive, and transformative initiatives from ‘young turks’, or the established operators with their metrics about client retention, record gross revenues and lawsuits combatted. So long as there is also a linked advertorial, and/or sponsorship of the annual industry awards.

Further as most artists, their management, promoters, venues, sponsors, and affiliates, know very little, if anything, about the logistics or service requirements of ticketing technologies, why should we expect the media covering the industry to be any better equipped.

Companies House

With regards to research for the post, the annual accounts of DICE were readily available (albeit some were delayed or not yet filed) and in the public domain via Companies House, for anyone to review. But no-one else bothered.

However, for those within the industry it was an open secret that there were issues.

VC Funding

With regards to the query, is the start-up funding model for new ticketing technologies and operators invalidated by the sale of DICE to Fever?

Not necessarily.

There are many, many small-to-medium-sized enterprises in the B-2-B / B-2-C / D-2-C ticketing and adjacent sectors (Access Control, CRM, Digital Wallets, ID Verification, POS, 3-D Seating Plans, etc.) that have raised relatively modest amounts to build, maintain, grow and become whisper-it-quietly, profitable companies.

They may also operate in emerging markets, not music-based genres (i.e. cinema, conferences + exhibitions, performing arts, sports, or tourism + leisure), be long-tail or international operators, but don’t necessarily attract the interest of consumer groups, mainstream media, or regulators that the retail ticket agencies, whether primary or secondary marketplaces do.

Following on from seed -funding via Friends+Family and then HNW (High-Net-Worth) Angels, arguably the purpose of Venture Capital is to enable earlier-stage, and speculative companies. Organisations whose funders more broadly welcome higher levels of risk-taking (i.e. speculating on the potential reward of a ‘unicorn’ exit) which includes those consciously disrupting historic models and behaviours, or less obviously by supporting those with little/no previous sector expertise applying a Silicon Valley truism of ‘moving fast and breaking things’.

It’s also relatively easy to develop an MVP long-tail General Admission solution but larger-scale clients typically require a more sophisticated series of API-integrated technologies – attendee identity + verification, bundles + packaging, payments, seat-row-block reserved seating, secure digitisation + encryption etc.

So, VC funding will only take you to a certain level <$10M, and then further growth / validation of the business will increasingly require the involvement of levels of Private Equity.

But, beware of companies that stress the purity and strength of their engineered product above all others – whilst ticketing has the veneer of technology it is still deeply mechanical and operational from event creation, marketing + distribution to the validation at point-of-entry etc., and the fiscal and incremental service contributions now routinely required from ticketing ‘Rights Owners’ means that access to surplus funds is often a key negotiating point.

And then the overwhelming majority of the large international conglomerates, with their vertical consolidation of IP, Production, Promotion, Performance and Retail – see ATG Entertainment, BookMyShow, CTS Eventim, Merlin Entertainments, Live Nation, Reed Sunaidi Exhibitions, Superstruct, TEG etc. – are all instruments of PE and late-stage capitalism, and if you want to effectively compete with those giants VC funds alone may not suffice.

That’s not to say that new technologies, business models, or distribution channels won’t have an impact going forward. Rather as the Situationists forewarned the recuperation of new radical ideas are often quickly co-opted, incorporated, or commodified by the mainstream ‘society of the spectacle’, so (inevitably) the bigger companies will continue to acquire smaller operators, unless limited by regulators.

***

Selling The Night

I had the great pleasure to attend a Velocity Press (https://velocitypress.uk/) evening (18.06.25) at Jumbi, Peckham (https://www.jumbipeckham.com/) where Andy Crysell discussed his book ‘Selling The Night. When club culture meets brands, advertising and the creative industries’ (https://velocitypress.uk/product/selling-the-night-book/).

After an introduction and overview of the book, he was then joined by a panel of nightlife advocates, evangelists and practitioners: Juliet Cromwell (Global Commercial Director | Clash); Patrick Duffy (Executive Creative Director | DICE); Ollie Oshodi (Cultural Strategist); and Rudi Minto de Wijs (Head of Curatorial | Jumbi).

A great evening. Thanks to all.

Then the following night (19.06.25) I attended LCD Soundsystem at Brixton Academy. A glorious hot n’sweaty acid-thrash rock discotheque.

Now have to now lie for a bit.

***

Until next time.