TJ Chambers

(c) freepik.com

Regular readers of these scribbles will know that I am a keen observer of, and occasional commentator on, the increasing level of live entertainment and ticketing sector consolidation. And further that private equity, the agent primarily driving this change of ownership and business practises, may not always have the development of art, or accessible engagement with culture, or even places the desire of audiences seeking fairly-priced tickets available via secure websites with equality-of-access, above their own priorities for franchising experiences, commodification of services and ‘squeezing-the-pips’ aka extracting profit.

(It’s also true that earlier in my professional career I may have played a small part in the international growth of one or two ticketing monopolists, so apologies for the hypocrisy or belated conscience. I blame the misguided arrogance of youth fuelled by a Web 1.0 belief in market transformation, and the sheer fun of engineering typically mutually advantageous deals – whether retail or commercial partnerships, joint-ventures or acquisitions. Albeit it was never as glamorous / louche as the HBO / BBC TV series ‘Industry’.)

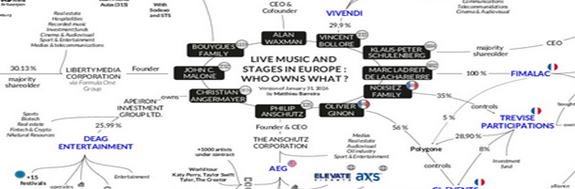

Anyway, two organisations Reset! (https://reset-network.eu/) and Live DMA (https://live-dma.eu/) have combined forces, with researcher Matthieu Barreira (https://www.linkedin.com/in/matthieu-barreira-6333a6173/) to map out who-owns-what in the European live music sector, and although much of this information is known (as least to market intel nerds), and although they do not claim that the study is a definitive one, the visual presentation of the ownership networks makes for compelling viewing.

[Extract] Map #1: Music Festivals in Europe, Who Owns What?

[Extract] Map #2: Live Music and Stages in Europe, Who Owns What?

For the full networks view here: Mapping Ownership Concentration in the European Live Music Sector- https://reset-network.eu/mapping-ownership-concentration-in-the-european-live-music-sector/.

Reset! is a European network of independent cultural and media organisations including venues, festivals, community radios, cinemas, bookshops, artistic hubs, booking agencies, local authorities and resource organisations, whilst Live DMA is a European network of national live music associations supporting over 3,000 live music spaces across 17 countries.

Their independence from the vertically aligned congloms of live entertainment is crucial as it allows the development of critical perspectives based on a deep understanding of the day-to-day reality of how the markets operate, without slavish adherence to a corporate orthodoxy that assumes internally-developed practices, whether exclusivity contracts or rebates, commissions and kickbacks, are generally ‘how-things-are-done’.

It’s not that there aren’t any creative thinkers within the multi-national companies, rather that the commercial focus of those organisations i.e. Profit+Loss, is typically the singular priority, with executives’ salary, stock, and other compensation orientated towards the attainment of fiscal KPIs reinforcing a corporate tunnel vision. Rather than having any consideration towards the wider cultural, educational, environmental, sustainability or welfare implications of their activities.

And specifically, within the live music industry concern towards supporting the next generation of artists or audiences, touring infrastructure and/or logistics i.e. the wider ecosystem, doesn’t quite match the commercial imperative of maximising revenues now.

Which is why the major operators only ever talk about record tour (or quarterly) revenues, fastest event sell-out (with additional rollover dates), social media impressions of promo-video activities, or the success they’ve had in converting what was previously secondary marketplace spend back to the event rights owners – in the belief it’s better that they gouge the ticket-buyer rather than unofficial channels.

‘… when we buy a ticket for a festival or a concert, who do we really support’ – Live DMA

The Reset! / Live DMA study was highlighted by Shawn Reynaldo in his First Floor (Substack) newsletter (#298 Another Week in Bizarro World, 5th February 2026 – https://firstfloor.substack.com/p/first-floor-298-another-week-in-bizarro), by Michael Lawson in Resident Advisor (Four corporations linked to over 150 major European festivals, new study shows, 5th February, 2026 – https://ra.co/news/84513) as well as by Sonia Chein in MusicAlly (Report finds four companies own majority of European music festivals, 10th February 2026 – https://musically.com/2026/02/10/report-finds-four-companies-own-majority-of-european-music-festivals/), but didn’t appear to gain much coverage within the mainstream music industry press – apologies in advance if I missed other postings. Possibly because it might draw attention to their own publication and website being owned by a venue operating conglom, or that the advertisers and sponsors of their annual awards / business conferences / trade publications might be embarrassed by having market dominance so openly discussed i.e. ‘more than 150 of the largest festivals in the EU – and over 200 when including the UK – are linked to just four groups: Anschutz Entertainment Group (AEG), Live Nation, CTS Eventim and Superstruct’.

***

An incredible lineup of companies are supporting ILMC 38, including platinum partners Live Nation and Ticketmaster; gold partners Legends Global and CTS Eventim; silver partners Showsec, Tysers Live, DEAG Entertainment Group, BWO Entertainment, and AXS; and Theory Eleven Entertainment. – https://38.ilmc.com/

***

Much like the recorded music industry which is dominated Universal Music Group, Sony Music Entertainment and Warner Music Group (who collectively account for approximately 80% marketshare), the live music industry increasingly has many of the characteristics of a monopsony (from the artist perspective) and monopoly (from the consumers).

This concentration of ownership to a smaller set of private equity fuelled operators inevitably places increased costs on access to talent, restrictions on availability of performing spaces (from the grassroots and emerging stages upwards), and diminishes the diversity of innovative cultural artforms, with a pivot towards a homogenised, franchised, dynamically priced product.

With somewhat less hyperbole, the lack of market competition increases operational costs to start-ups or independents at every level, restricts access to artists tied to multi-territory festival or touring exclusives, diminishes market breakthrough for local or regional ticketing partnerships, and detrimentally impacts their ability to attract media, broadcasters, advertisers, or sponsors.

For a more learned or academic explanation of the impact of PE on the entertainment industries: ‘Derivative Media. How Wall Street Devours Culture’, Andrew deWaard, University of California Press – https://www.ucpress.edu/books/derivative-media/paper.

***

The AI ‘Bubble’

Elsewhere. The gap between AI’s future-facing transformative promise (apparently so very bright, that you’ve gotta’ wear shades, an obscure reference to Timbuk3) and its current delivery means that any eventual payoff is an expensive medium-term gamble, with any productivity gains thus far remaining stubbornly elusive.

But have no doubt if it’s all (eventually) a glorious success the profits will be retained by the evangelistic Amazon, AMD, Anthropic, Alphabet (Google), IBM, Meta, Microsoft, Nvidia, OpenAI, Oracle, Palantir and others, but if it turns out to be a(nother) speculative bubble then you can be certain, like the banks before, and others deemed ‘too big to fail’, that we’ll be the ones to bail them out.

According to the tech giants that have already invested billions, and billions (Big Tech groups race to fund unprecedented $660bn AI spending spree, Tim Bradshaw, 8th February 2026 – https://www.ft.com/content/d503afd5-1012-40f0-8f9d-620dcb39a9a2), of dollars on AI infrastructure (data centres, quantum computing, and semiconductors, whilst also investigating new nuclear power sources etc.) that the problem isn’t the technology. Rather it’s how people and organisations are implementing it.

Essentially AI is being employed to augment pre-existing processes, typically in an attempt to part-replace (some) human activities with a level of machine automation.

Within ticketing the most obvious AI-integrations have occurred within the administration and/or interrogation of databases and CRM systems i.e. predictive analytics enabling better-targeted marketing and event planning, albeit the resulting AI-generated statistics may appear authoritative but do require factchecking.

AI systems are also being deployed within various fraud prevention protocols, identifying multiple purchase attempts by bots, duplication of ticket-buyer identities, and the automation of online queues and purchase processing.

Aspects of event discovery, or content creation have thus far been less developed in part due to the well-documented hallucinations or plausible-but-incorrect output of LLM’s.

AI is however powering some level of conversational commerce as well as the provision of interactive Customer Service FAQ’s where it acts as an amplifier of ‘official’ event Terms & Conditions created elsewhere. But there is a level of frustration when contrasted with search engine results where shorter queries typically yield better results, whereas for generative AI, apparently, the opposite holds true.

The one aspect of ticketing that has quickly adopted AI is within ‘dynamic pricing’. The ability to adjust ticket prices in real-time based on demand and buyer behaviour, whilst also increasing show grosses – preferably ‘invisibly’, so as to avoid accusations of blatant surge-pricing.

All these deployments are being continuously refined and increasing the overall levels of automation but are (currently) still requiring human interaction and direction.

Ultimately the further adoption of AI will depend on the incremental CapEx implications in a highly commodified sector already experiencing low margins and an ever-evolving technical delivery.

***

And in other news, the Kennedy Center / Richard Grenell / Live Nation intertwined saga continues – for a little recent background see: A Record One-Day STR … And in other news (30.01.26) – https://tjchambers.blog/2026/01/30/a-record-one-day-str-and-in-other-news-30-01-26/.

Recently, Trump announced the closure of the venue for two years (Trump Says Kennedy Center Will Close for 2-Year Reconstruction Project, 2nd February 2026 – https://www.nytimes.com/2026/02/01/us/politics/trump-kennedy-center.html), for ‘construction, revitalization and complete rebuilding’ despite the Kennedy Center having undergone extensive renovations at a cost of $250M in 2019 (You have lots of questions about Trump’s Kennedy Center renovation. We do, too, Anastasia Tsioulcas, 4th February 2024 – https://www.npr.org/2026/02/02/nx-s1-5696489/kennedy-center-renovation-trump-questions). So obviously nothing to do with the ongoing staff redundancies, artist boycotts and declining ticket sales experienced during the Trump regime.

Days later, it was reported that there was disagreement within the Department of Justice over ‘settlement talks’ between Live Nation executives, their lobbyists and ‘senior DOJ officials’ to avert any trial (Exclusive / Live Nation settlement talks are dividing Trump’s DOJ, Rohan Goswami, Liz Hoffman, and Ben Smith, 9th February 2026 – https://www.semafor.com/article/02/08/2026/live-nation-settlement-talks-are-dividing-trumps-justice-department), with DOJ antirust chief Gail Slater being sidelined.

Then it was disclosed as part of the Trump’s ongoing campaign to remodel the cultural institution (alongside cutting out the ‘woke’ programming and introducing marble seat rests ?!?), that discussions were taking place to integrate Live Nation’s Ticketmaster to the facility with Richard Grenell having to recuse himself (Kennedy Center President, and Live Nation Board member) to recuse himself (Behind Trump’s Push to Remake the Kennedy Center in His Own Image, Annie Linskey, Jessica Toonkel, Josh Dawsey and Dave Michaels, 10th February 2026 – https://www.wsj.com/business/kennedy-center-donald-trump-d7a055c3).

This inevitably led some observers to believe that the DOJ was now poised to withdraw any action against Live Nation-Ticketmaster (Trump Justice Department Poised to Preserve Ticketmaster Monopoly, David Dayen, 12th February, 2026 – https://prospect.org/2026/02/12/trump-justice-department-ticketmaster-live-nation-monopoly/, + Top DOJ antitrust enforcer is out weeks before Live Nation trial, Lauren Feiner, 12th February 2026 – https://www.theverge.com/policy/878163/doj-antitrust-chief-gail-slater-departs), and it therefore came as no surprise that Gail Slater then stepped down (Donald Trump’s top antitrust enforcer Gail Slater pushed out as turf war deepens, Arash Massoudi, James Fontanella-Khan and Stefania Palma, 12th February 2026 – https://www.ft.com/content/19f800f5-8b21-489c-8ba2-9ebb628fc38b).

***

Separately, Kid Rock had obviously read the situation correctly and despite recently testifying against Live Nation-Ticketmaster (U.S. Senate Committee Commerce, Science And Transportation – Examining the Impact of Ticket Sales Practices and Bot Resales on Concert Fans, 28th January 2026 – https://www.commerce.senate.gov/2026/1/examining-the-impact-of-ticket-sales-practices-and-bot-resales-on-concert-fans_2) announced 12th February (https://x.com/KidRock/status/2021751111485415765) that he will be teaming up with Live Nation to use Ticketmaster‘s Face Value Exchange Policy for his ‘Freedom 250’ tour.

***

Basically, WTF.

Or as an American friend of mine commented ‘… with this administration, everything in our government has a price tag on it. The corruption is so rampant it has become expected and almost institutionalized for this administration. Truth and justice have been replaced by bribes and self-dealing. One can no longer look at a case like the LN monopoly claim and evaluate it on its legal merits, but rather by following the money on who is paying those with influence.’

***

Until the next time.