TJ Chambers

4th January 2025

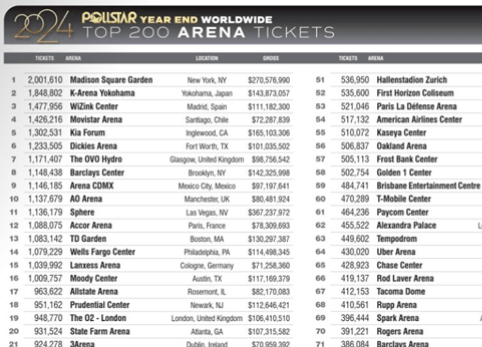

A year ago (Feb’24) whilst reviewing Pollstar’s reporting of annual tickets sales I noted (https://www.linkedin.com/pulse/sycophants-stenographers-adding-up-live-music-tim-chambers-9vihf/) that for The O2, London there appeared to be a discrepancy between the figures stated by the venue, and those reported by the magazine in its charts.

Apparently ‘the world’s busiest arena’ a venue that reported 2.5M ticket sales during 2023 (https://www.theo2.co.uk/news/detail/the-worlds-busiest-arena-the-o2-celebrates-record-breaking-2023), was only #3 in the Pollstar Magna Chart Top 100 Arenas (https://news.pollstar.com/2024/02/22/uk-euro-venues-are-building-on-strong-2023-more-blockbuster-entertainment-for-sure-6th-annual-magna-charta-special/) with 1,167,294 sales as recorded by the publication.

© Pollstar

I (rhetorically) queried as to what caused this apparent difference in reported ticket sales – whether it was a failure by artists, promoters and/or the venue to report a publication owned by a competing venue operator, or some other reason.

Anyway, one year later and The O2, London announces an increase in ticket sales by 2.3% to a record-setting 2.6M (https://www.theo2.co.uk/news/detail/at-the-top-of-its-game-the-o2-celebrates-another-record-breaking-year-at-the-worlds-busiest-live-entertainment-arena), whilst Pollstar reports the venue is a lowly #19 in the 2024 Worldwide Top 200 Arena with 948,770 tickets.

© Pollstar

Shame on everyone involved.

How can the industry expect to be taken seriously by participating operators let alone analysts, business funders, commercial partners, market media, governments or regulators, if it can’t be relied upon to accurately reflect the scale and diversity of actual ticket sales and revenues.

***

https://www.vecteezy.com/free-vector/button

‘Sycophants and stenographers’* – adding up the live music industry.

February 24, 2024

Alongside Billboard (https://www.billboard.com/), IQ Magazine (https://www.iq-mag.net/), Music Ally (https://musically.com/), Music Business Worldwide (https://www.musicbusinessworldwide.com/), Music Week (https://www.musicweek.com/), Ticketing Business (https://www.theticketingbusiness.com/) and Variety (https://variety.com/), I appreciate Pollstar’s (https://www.pollstar.com/) content which typically attempts to offer something more than the reprint of various company press releases.

Another key differentiator for Pollstar subscribers is the various industry contacts directories, access to box office and touring route book histories for artists and venues, and their quarterly statistical reports which present box office data (as reported to Pollstar) for ‘Tours, Promoters, Clubs, Theatres, Amphitheatres, Arenas, Stadiums and Festivals’ across various global territories.

Unfortunately, the key disclaimer in their oft-quoted live industry reports, is ‘as reported to Pollstar’.

So you have articles like the recent (22.02.24) ‘UK & Euro Venues Are Building On Strong 2023: ‘More Blockbuster Entertainment, For Sure’ (6th Annual Magna Charta Special)’ by Gideon Gottfried (https://news.pollstar.com/2024/02/22/uk-euro-venues-are-building-on-strong-2023-more-blockbuster-entertainment-for-sure-6th-annual-magna-charta-special/) which states: ’The world’s busiest arena, The O2 in London, England, celebrated a record 2023, selling more than 2.5 million tickets, according to senior vice president and general manager Steve Sayer. 1,167,294 of those tickets had been reported to the Pollstar Boxoffice in the reporting period Feb. 1, 2023 to Jan. 31, 2024, placing the building on the top spot in terms of gross ($139,963,549), and on the third spot in terms of reported number of tickets sold.’

How is it that the ‘world’s busiest arena’ with more than 2,500,000 ticket sales, became #3 in the Pollstar Top Arenas chart with only 1,167,294?

Obviously The O2 arena isn’t misinformed about its ticket sales. But equally, Pollstar can only accurately report the figures provided to it.

So maybe some of the missing 1,332,706 tickets sales weren’t ‘music’, in an arena that unlike many others has no resident sports team(s).

Or maybe the ticket sales reports simply got lost in the post? Or were never sent?

But why wouldn’t AEG (https://aegworldwide.com/) the owners of The O2 arena would want to more accurately reflect the scale of the success of its ‘world’s busiest’ arena?

And why wouldn’t Pollstar want to more precisely define actual ticketing volumes and turnovers – given it’s up-selling ticket sales data as part of its commercial operations.

It’s obviously not because Pollstar is a wholly owned subsidiary of Oak View Group (https://www.oakviewgroup.com/), ‘an American professional sports and commercial real estate company’ that is competing with AEG Facilities for global venue development and operations.

Equally unlikely is that all other Artists and Promoters (especially those competing with AEG Presents – https://www.aegpresents.com/ / https://www.aegpresents.co.uk/) who operate in live music and who are keen to be noticed for the ticketing sales and revenues they deliver, wouldn’t provide their tour data when it involves their prestigious performance at The O2.

And similarly other Promoters and Venues obviously wouldn’t withhold their ticketing data from Pollstar in an attempt to insulate their individual company performance from any media reported sector downturn that runs contrary to their relentlessly upbeat quarterly results.

So, if Pollstar’s data isn’t as accurate as it could be, perhaps because of accidental omission, competitive tension and jealousy, or mis-filing, is there a trade association, collection agency, or regulatory authority that aggregates all ticketing data and then is able to present it to industry operators, competition authorities, governments, and tax agencies?

In some territories for example, Australia (Live Performance Australia – https://liveperformance.com.au/), Canada (Canadian Live Music Association – https://www.canadianlivemusic.ca/), Denmark (Music Export Denmark – https://mxd.dk/), France (Centre National de la Musique – https://cnm.fr/), the Netherlands (Pop Live – https://www.poplive.nl/) and the UK (LIVE – https://livemusic.biz/) there are, and also since the impact of the pandemic there has been great progress made by various music sector lobby groups – Music Venue Trust (https://www.musicvenuetrust.com/), National Independent Venue Association (https://www.nivassoc.org/) and Night Time Industries Association (https://ntia.co.uk/) – all working towards accurately mapping out the actual scale and diversity of live music, but there is currently no single authoritative global data set.

So, we have Pollstar, and honestly, it’s a valuable start, but come on, the industry needs better.

(*© Will Page / Richard Kramer ‘BubbleTrouble’ Podcast: https://www.bubbletroublepodcast.com/ )

LinkedIn: https://www.linkedin.com/pulse/sycophants-stenographers-adding-up-live-music-tim-chambers-9vihf/

***